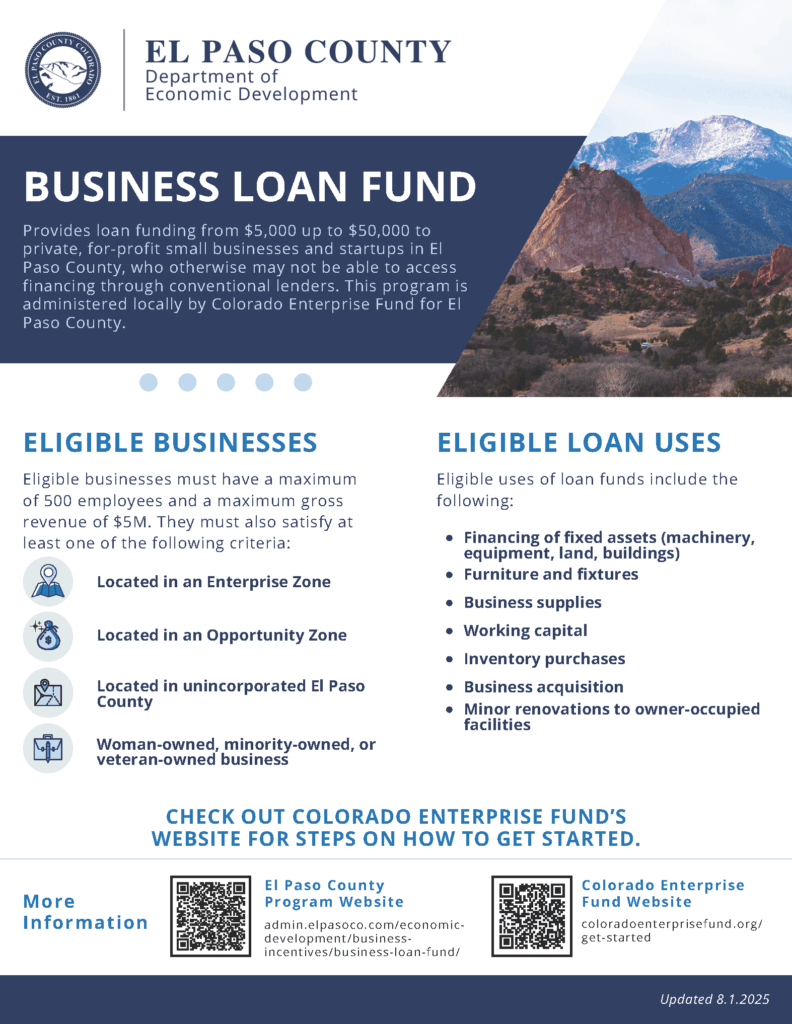

The El Paso County Business Loan Fund (BLF) program provides loan funding to private, for-profit small businesses and startups in El Paso County who otherwise may not be able to access financing through conventional lenders. The BLF program is administered locally by Colorado Enterprise Fund (CEF) for El Paso County. Borrowers have access to loan funding and wrap-around support services, such as education, consulting and/or mentorship, and technical assistance services through CEF. Loans range from $5,000 – $50,000.

About the Program

Learn More and Apply

If you are interested in learning more and starting the application process, click “Get Started” to head to Colorado Enterprise Fund’s website to find out more information about required documentation, resources available, and steps needed to apply.

Eligibility Requirements

For-Profit

Businesses must be for-profit entities.

Small Business

Businesses must have 500 or less employees.

Annual Revenue Cap

Businesses must have $5M or less in annual revenue.

Eligible businesses must also meet at least one of the following conditions:

Eligible Loan Uses

- Financing of fixed assets (machinery, equipment, land, buildings)

- Furniture and fixtures

- Business supplies

- Working capital

- Inventory purchases

- Minor renovations/rehabilitation to owner-occupied facilities

- Business acquisition

Loan Parameters

Loan parameters depend on multiple factors and specific loan needs. Loan terms typically range anywhere from 1-10 years, and the interest rate is fixed, depending on loan size and terms. All loans are fully collateralized and personal guarantees are required of all borrowers.

Contact Us

Katie Plutz

Economic Development Analyst

9 E. Vermijo Ave.

Colorado Springs, CO 80903

719-520-7493

katieplutz@elpasoco.com